ESTATE

PLANNING

We prepare documents to set your mind at ease so your wishes

can be carried out in the event you are unable.

20 Years of Experience Preparing, Guiding and Advocating for Clients through the Expected and Unexpected

MEDIATION

PROBATE & WILL CONTESTS

We guide you through probating estates and represent you in Will Contests.

When you want to resolve a Will Dispute and avoid a potentially lengthy and stressful court case.

Dedicated to helping clients and families prepare for the future and navigate the unexpected.

Preparing for tomorrow, for peace of mind today.

Helping loved ones navigate after a loss.

Decades of experience

guiding clients through life's unexpected challenges including Probate Court. Informal or Formal Probate and WIll Contests.

Mediating Will Disputes to stay out of court, avoid costly litigation and importantly attempt to salvage family relationships.

CONTACT US

OUR SERVICES

Wills and EState Plans

We have comprehensive Flat Fee Estate Plans for all types of Situations. All of our Estate Planning Services included a Power of Attorney and a Health Care Proxy to guide your loved ones and take care of business when you are unable.

Probate Distribution

We formally and informally Probate the Estates of loved ones.

Probate Litigation

If a Will Dispute happens - whether you are on the receiving end of a challenge or you feel that the Will left by your loved one was improperly influenced, there is another will, it wasn't executed properly, they were incapable of forming intent....or for any reason we offer representation and consultation

mediation and dispute resolution

The death of a loved one is a stressful, life altering and emotional event. Quite often, these emotions lead to family members challenging an estate. Attorney Foley is a certified mediator with the skill, empathy and compassion to mediate family disputes in the hopes of preventing irreparable damage to family relatioships.

Tel. 781-214-0214

jessica@jessicafoleylaw.com www.jessicafoleylaw.com

Main Office

15 Cottage Ave. 4th Floor

Quincy, MA 02169

We are available for consultations and meetings via zoom or in person. We offer evening appointments.

CONTACT US

(Legal stuff: This website contains legal information, however, reading it does not establish an attorney-client relationship. Emailing, calling, leaving a voicemail, sending a direct message - does not create an attorney-client relationship.)

(C) 2023 JESSICA FOLEY LAW website created by Funky 143, Inc.

Need to Probate an Estate?

Questions about Will Contests?

are you being dragged into a will contest?

You have come to the right place! Attorney Foley has over twenty years of experience helping clients and advocating in court, mediations and administrative hearings.

A graduate of Smith College and Northeastern University School of Law, Attorney Foley has spent her career guiding clients through difficult life challenges and events.

Law Office of jessica Foley Blog

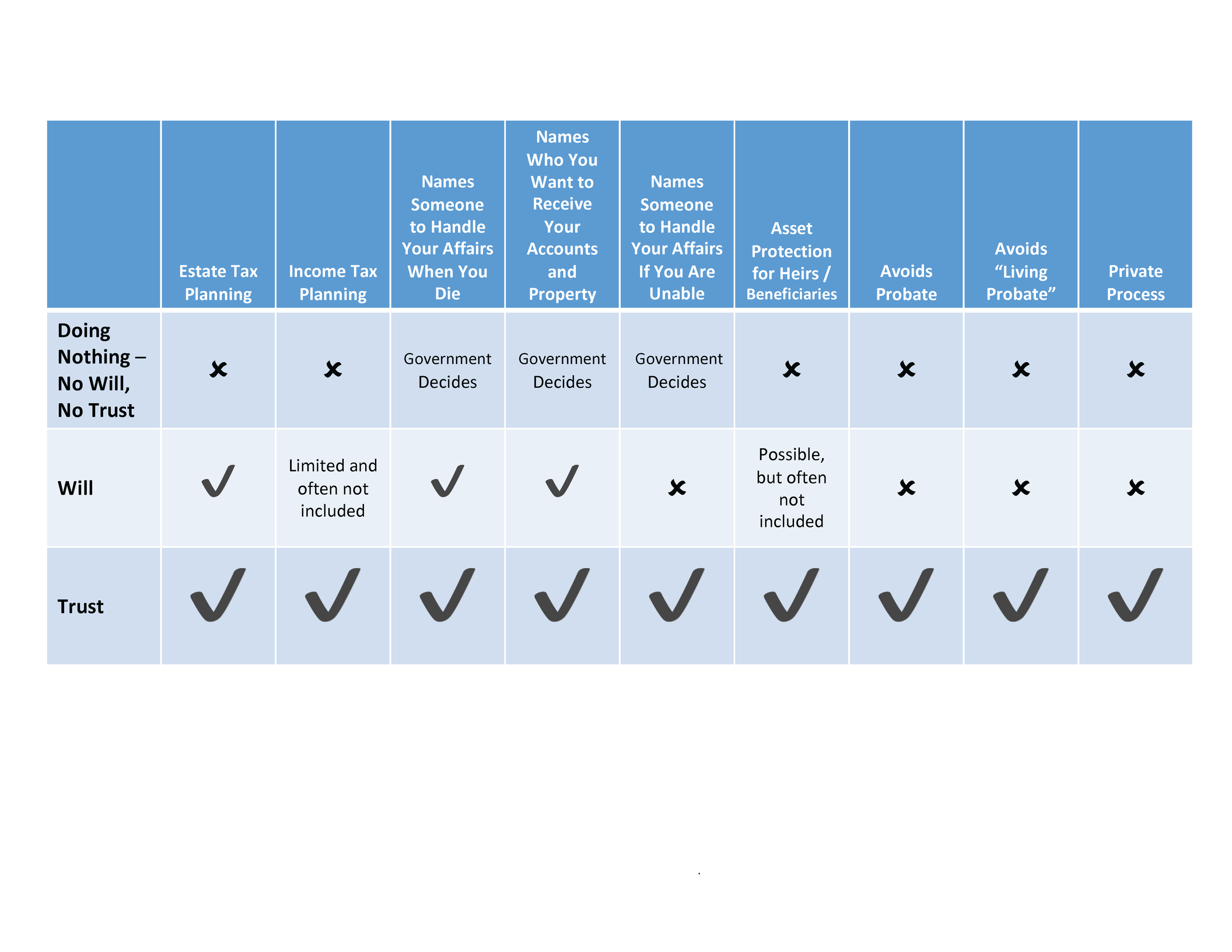

What’s right for you - doing nothing – a will – a trust?

The answer depends on your circumstances and we are here to help.

This is for Illustration purposes only.

Consult with a qualified professional before making any legal, tax, or investment decisions

CONTACT US

(Legal stuff: This website contains legal information, however, reading it does not establish an attorney-client relationship. Emailing, calling, leaving a voicemail, sending a direct message - does not create an attorney-client relationship.)

(C) 2023 JESSICA FOLEY LAW website created by Funky 143, Inc.

IS YOUR ESTATE PLAN UP TO DATE?

Take this simple test to FIND OUT:

1. Have you prepared a will or a trust?

Without proactive planning, you are relying on the state legislature to determine how your assets pass, to whom they pass, and when they pass. In addition to having potentially undesired results, this is perhaps the most costly and time consuming means of passing your assets to your loved ones.

2. If you have done a will or trust, has it been reviewed in the last two years?

Even assuming that there have been no family or financial changes since your plan was last reviewed, there have been multiple and significant tax law changes since 2001. An out-of-date estate plan is perhaps worse than no estate plan at all. Our experience is that people view estate planning as an event rather than a process. Keeping your plan current is vital to achieving the goals you set out to accomplish.

3. Are all of your heirs over the age of 21 and financially responsible?

Under state law, children inherit property no later than age 21 without restriction. Proper planning is crucial to prevent an heir from squandering his or her inheritance, or worse, from causing harm to himself or herself.

4. Are you absolutely certain that your assets will not be subject to probate?

We encourage you to make a list of each asset you own and identify how each asset is going to avoid probate. Assets owned as “joint tenants with rights of survivorship,” assets owned in the name of a trust, and assets that pass by beneficiary designation (such as IRAs, life insurance, etc.) will avoid probate. Everything else is subject to probate. (Also, note that assets owned jointly are typically subject to probate upon the death of the last joint tenant.) Probates can be costly and typically require twelve (12) to eighteen (18) months from the date of death to conclude.

5. Do you have assets titled jointly with a child or children, or someone else?

Holding assets jointly with someone other than a spouse is quite common, but has some potentially devastating consequences of which most people are unaware. A creditor of a joint tenant can take the entire asset to satisfy the creditor’s claim. A creditor would include a divorcing spouse, judgment creditor, or business creditor. Additionally, problems can be created if joint tenants die in the wrong order.

6. Does your current plan provide your heirs with asset protection, divorce protection, and lawsuit protection?

The most common means of providing for heirs is with outright distributions. By doing so, however, the inheritance becomes subject to the creditors of your heirs.

7. Is this your first marriage?

Second or subsequent marriages present unique planning issues, particularly if both spouses have children from a prior marriage. Proper planning is critical to prevent undesired results.

If you answered “No” to any of the above questions or “Yes” to #5, you should make an appointment to speak to an attorney about your estate plan.

GET STARTED

(Legal stuff: This website contains legal information, however, reading it does not establish an attorney-client relationship. Emailing, calling, leaving a voicemail, sending a direct message - does not create an attorney-client relationship.)